As a freelancer or gig worker, you operate outside the traditional employer-employee relationship. While this provides flexibility, it also means you lack access to traditional benefits like employer-sponsored retirement plans. With Social Security being a major source of retirement income for American workers, understanding how to optimize your benefits is crucial.

This article provides tips about the eligibility of social security in the gig economy, benefit amounts, spousal benefits, and strategies to boost your monthly check. We’ll explain how earnings impact your future payments and help you navigate this new frontier where W-2 employees clocking in for large firms no longer dominate. You’ll learn how to strategically supplement Social Security to achieve retirement readiness.

Understanding Benefits of Social Security in the Gig Economy

As a freelancer, you are considered self-employed and are responsible for paying the full Social Security tax of 15.3% on your net earnings. Unlike traditional employees, no employer will pay half of your Social Security contribution. However, paying the full tax means you may be eligible for greater Social Security benefits when you retire.

Contributing Enough to Qualify

To qualify for Social Security benefits, including retirement benefits, you need 40 credits (about 10 years of work). As a freelancer, you can accumulate up to four credits annually determined by your yearly earnings. In 2021, you acquire one credit for every $1,470 in net earnings, with a maximum of four credits.

Calculating Your Benefits

Your Social Security benefits are based on your 35 highest-earning years of contributions. Years with no earnings or low earnings will be counted as zeros. As a freelancer, you may have years with little or no work, which can reduce your benefits. However, you can make up for those lost years by contributing more in your peak earning years, since Social Security takes your best 35 years into account.

Options to Increase Your Benefits

If there are years you were unable to contribute much due to lack of work or low earnings, consider these options to boost your future Social Security benefits:

•Make estimated quarterly tax payments – Instead of paying Social Security taxes only when you file your annual tax return, make quarterly tax payments to fund more of your Social Security credits.

•Contribute the maximum – In your peak earning years, contribute the maximum amount allowed to Social and earn the maximum four credits. Your higher earning years will help offset years with little or no earnings.

•Defer claiming benefits – While you can claim Social Security as early as age 62, your benefits will be higher if you defer claiming until your full retirement age (currently 66 or 67). Delaying until age 70 results in maximum benefits.

As an independent freelancer, planning and maximizing your Social Security contributions and benefits requires diligent effort on your part. But with the right strategies, you can set yourself up for more substantial benefits to fund your retirement.

How to Qualify for Social Security as a Freelancer

Report Your Earnings Accurately

As an independent contractor, you must report all of your earnings to the IRS to qualify for Social Security benefits. Make sure you keep excellent records of all payments received from clients as well as any business expenses. Report your income and expenses on Schedule C, the form for business income and expenses. Your net earnings from self-employment are reported on Schedule SE, which is used to calculate your Social Security tax liability.

Pay the Full Social Security Tax

Employers typically pay half of the Social Security tax for employees. However, as a self-employed individual, you must pay the full 12.4% Social Security tax yourself. This includes both the employee and employer share. Paying the full tax ensures you earn Social Security credits toward future benefits.

Earn Enough Credits

To qualify for Social Security benefits, including retirement, disability, and survivor benefits, you need to earn a minimum number of credits, which are based on your reported earnings. In 2020, you earn one credit for every $1,410 in net earnings from self-employment. Most people need 40 credits to qualify for benefits. The number of credits needed depends on your age and the type of benefits.

Meeting the requirements to qualify for Social Security is challenging but essential for freelancers and independent contractors. Accurately reporting your income and expenses, paying the self-employment tax in full, and earning enough credits will help ensure you have access to benefits when needed. While navigating the requirements may seem complicated, the potential future benefits make the effort worthwhile.

Maximizing Your Social Security Benefits

To make the most of Social Security in the gig economy, you need to understand your options and make strategic decisions.

Work Enough Years

You need to have earned enough work credits to qualify for benefits. In 2021, you need 40 credits to qualify for retirement benefits, and you can earn up to four credits per year. As a freelancer, make sure you continue earning credits each year through your self-employment income.

Increase Your Earnings

Your Social Security benefit amount depends on your average earnings over your working career. Focus on taking higher-paying freelance jobs and increasing your rates over time to boost your average earnings.

Consider Delaying Benefits

You can start claiming Social Security as early as age 62 or as late as age 70. For each year you delay claiming past your full retirement age (currently 66 or 67), your benefits increase by about 8% annually. Delaying allows your benefits to grow and also increases your spouse’s survivor benefit. However, if your health is declining it may make sense to claim earlier. You need to weigh your options based on your situation.

Account for the Social Security Tax

As a self-employed individual, you must pay the full Social Security tax of 12.4% on your net earnings (up to the annual maximum). Pay this tax quarterly to avoid penalties and ensure you earn credits for your work. Account for this substantial tax in your business budget and pricing.

Research Spousal Benefits

If you are married, your spouse may be able to claim benefits based on your work record when you start claiming Social Security. Spousal benefits may amount to as much as 50% of your benefit. Your spouse is eligible for spousal benefits even without earning sufficient credits for individual Social Security qualification. Explore various options to identify the best strategy for your specific situation.

Following these steps will help you navigate Social Security strategically as a freelancer and gain the maximum benefits possible from the system over your working life. Stay up-to-date with Social Security rules which change frequently to make the soundest decisions regarding your benefits.

When to Start Taking Social Security Benefits

As a freelancer, determining when to start claiming your Social Security benefits is an important financial decision. You have the flexibility to start claiming as early as age 62 or as late as age 70. However, the longer you delay claiming, the higher your monthly benefit will be.

Claiming at Age 62

You are eligible to receive Social Security benefits as early as age 62, but claiming before your full retirement age (typically 66 or 67) may result in a reduction of up to 30% in your monthly benefit. While some may find the reduced benefit worthwhile for earlier access, if you claim at 62 and continue working, your benefits might be temporarily reduced if your earnings surpass the annual Social Security earnings limit.

Delaying Until Full Retirement Age

By delaying until your full retirement age (66 or 67), you ensure you receive your full Social Security benefit amount with no reduction. You can continue working with no penalty or reduction to your benefits. For many freelancers, full retirement age may be the optimal time to start claiming benefits.

Delaying Until Age 70

For maximum benefits, you can delay claiming until age 70. Your benefit will increase by a guaranteed 8% per year between full retirement age and 70. This results in a benefit amount 32% higher than if you claimed at full retirement age. While delaying means going longer without benefits, the permanently higher benefit amount makes it worth it for some, especially if you expect to live well into your 80s or beyond.

The right choice for you depends on your financial situation, health, and longevity. It may help to use the Social Security Administration’s calculator to determine your estimated benefits at different starting ages so you can make an informed decision. With some planning, you can maximize this important source of retirement income.

Impact of Freelancing Income on Social Security Benefits

Contribution Towards Social Security

As a freelancer, you are considered self-employed and therefore responsible for paying the full Social Security tax rate of 15.3% on your net earnings (12.4% for Social Security and 2.9% for Medicare). The Social Security Administration (SSA) considers your net earnings to be your gross income from self-employment minus deductions for business expenses. Your contributions are paid annually through Form 1040. Failure to pay the requisite Social Security tax can negatively impact your Social Security benefits upon retirement.

Eligibility for Social Security Benefits

To qualify for Social Security benefits like retirement, disability or survivors benefits, you must earn a minimum number of credits by contributing to Social Security through your self-employment income. As of 2021, you need 40 credits to qualify for benefits. Freelancers typically earn 4 credits per year. Your actual Social Security benefit amount will depend on your 35 highest-earning years. Years with little or no income due to lack of work will likely reduce your future Social Security benefits.

Strategies to Maximize Social Security Benefits

There are several strategies freelancers can utilize to maximize future Social Security benefits:

- Pay Social Security tax on your net earnings to earn the maximum 4 credits per year. This will ensure you qualify for benefits and build up credits for higher benefits.

- If income fluctuates, focus on earning maximum credits during higher-income years. Lower-income years with 1-3 credits will not significantly impact your benefits.

- Consider forming an S corporation and paying yourself a salary. A salary allows you to pay Social Security tax on only the salary amount versus all your net earnings. The remaining earnings can be distributed as dividends, exempt from Social Security tax.

- Delay claiming Social Security benefits until age 70 if possible. Benefits increase by a guaranteed 8% per year between ages 62 and 70. This can significantly increase your monthly benefit.

Freelancing provides flexibility and freedom, but also uncertainty. Implementing strategies to maximize your Social Security benefits will provide greater financial security and stability in your retirement years. With some advance planning, freelancers can navigate Social Security and enjoy the best of both worlds.

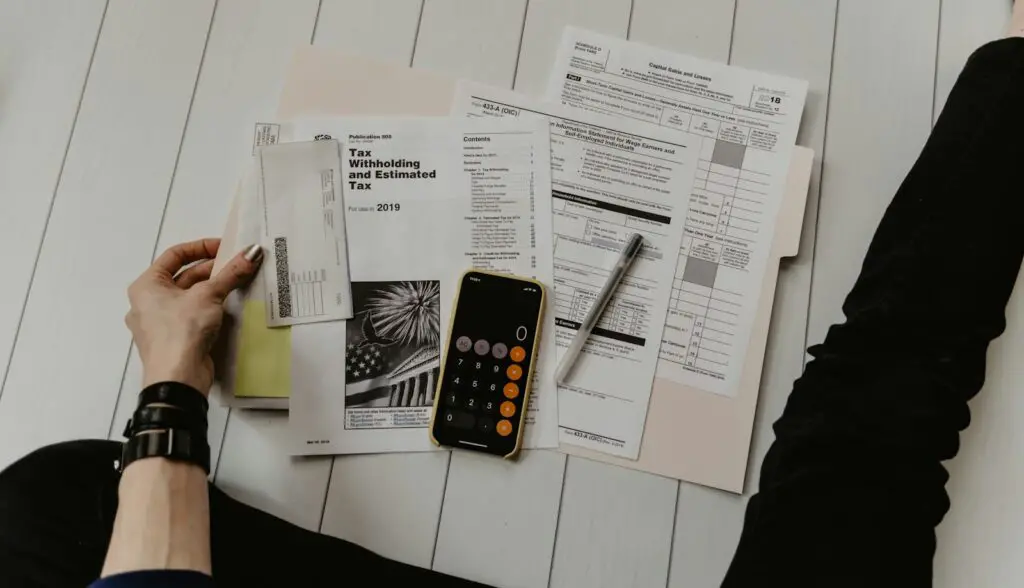

Paying Self-Employment Taxes as a Freelancer

As a freelancer, you are responsible for paying self-employment taxes on your income since you do not have an employer withholding taxes from your paycheck. The self-employment tax rate is 15.3%, which covers your Social Security and Medicare taxes. You will need to pay this tax on your net earnings from self-employment.

Calculate Your Self-Employment Tax

To calculate your self-employment tax, first determine your net earnings from self-employment by subtracting any business expenses from your gross income. You will then multiply your net earnings by 0.153 to get your self-employment tax amount. For example, if your net earnings from self-employment are $50,000, your self-employment tax would be $7,650 (0.153 x $50,000).

Make Quarterly Estimated Tax Payments

As a self-employed individual, you must make quarterly estimated tax payments. Estimated tax payments include both income tax and self-employment tax. The quarterly due dates for estimated tax payments are:

-April 15 (for income earned from January 1 to March 31)

-June 15 (for income earned from April 1 to May 31)

-September 15 (for income earned from June 1 to August 31)

-January 15 of the following year (for income earned from September 1 to December 31)

You must pay at least 90% of your total tax liability for the current year or 100% of the tax liability for the previous year, whichever is less. If you do not pay enough estimated tax, you may owe interest and penalties.

Report Self-Employment Income and Taxes

You will report your self-employment income and calculate your self-employment tax on Schedule C and Schedule SE when you file your annual tax return. Be sure to keep good records of your income and expenses to claim all allowed deductions and ensure you pay the proper amount of self-employment tax.

Carefully managing your self-employment taxes and estimated quarterly payments as a freelancer can help ensure you stay in good standing with the IRS and maximize your Social Security benefits in the future. The key is keeping accurate records, calculating your liabilities correctly, and paying on time.

Social Security Retirement Planning Tips for Freelancers

As a freelancer, you have additional considerations when planning for retirement. Calculating Social Security benefits relies on the highest 35 years of earnings, making the variable income from freelancing a potential obstacle. However, with prudent planning, you can maximize your Social Security in retirement.

Start Contributing Early

Pay into Social Security as early as possible in your freelancing career. Social Security uses your highest 35 years of earnings to calculate your benefits, so the sooner you start contributing, the more time you have to earn the required credits and build up your average income. If there are years your income is low due to the variable nature of freelancing, your benefits calculation will exclude those lower years if you have 35 higher-earning years.

Consider Self-Employment Tax

Freelancers must pay self-employment tax which funds Social Security and Medicare. The self-employment tax rate is 15.3% of your net earnings. Paying this tax ensures you earn credits toward Social Security and establishes your earnings record. You calculate and pay self-employment tax when filing your annual tax return.

Increase Your Earnings

Work to consistently increase your earnings over the years. Not only will higher earnings result in higher Social Security benefits, but it can also help maximize the number of years used in the benefit calculation formula. If your earnings are lower in some years due to the ups and downs of freelancing, higher earnings in other years can counterbalance them. Focus on developing your skills, finding higher-paying clients, and negotiating higher rates to boost your income over time.

Consider a Simplified Employee Pension (SEP) IRA

A SEP IRA allows freelancers to contribute up to 25% of their self-employment income, up to a maximum of $57,000 for 2020. Contributions are tax-deductible and the account can grow tax-deferred until withdrawal in retirement. SEP IRA funds, when withdrawn, can provide income to supplement your Social Security benefits. Maximize contributions whenever possible to take advantage of the tax benefits and compounding returns.

Planning for retirement as a freelancer requires diligence to overcome the challenges of inconsistent income. However, by starting contributions early, maximizing your income, and utilizing retirement accounts, you can build financial security for your future. With prudent management of your Social Security and other retirement funds, you can enjoy the rewards of your hard work in your golden years.

Other Retirement Savings Options for Freelancers

As a freelancer, you have several options outside of Social Security to save for retirement. Contributing to tax-advantaged accounts like an individual retirement account (IRA) or a solo 401(k) can help supplement your Social Security benefits and ensure financial security in your later years.

An IRA permits annual contributions of up to $6,000 ($7,000 for those 50 or older) for 2019 and 2020. Deductibility depends on income and IRA type. A solo 401(k) allows contributions up to $56,000 for 2020 ($63,500 if 50 or older). While offering higher limits than an IRA, solo 401(k)s often entail higher fees and increased complexity.

For freelancers with irregular income, a SEP IRA may be ideal. It permits employers (in this case, yourself) to contribute up to 25% of compensation or $57,000 for 2020, whichever is less. Contributions are discretionary, so you can put money in when business is good and skip contributions when needed. A SIMPLE IRA is another option, allowing $13,500 in employee contributions and $3,000 in catch-up contributions (if 50 or older) for 2020.

Some freelancers consider investing in real estate, the stock market, or other ventures to generate returns for retirement. However, the risks are higher, and you could lose money. It is best to max out tax-advantaged accounts first before investing elsewhere.

Regardless of your decision, commence saving for retirement at the earliest opportunity. Even modest, consistent contributions accumulate over time, leveraging the benefits of compounding returns. Consult a financial advisor to identify the optimal combination of accounts and investments, considering your income, tax bracket, risk tolerance, and retirement objectives. Diligent saving will contribute to securing a prosperous retirement.

FAQs on Social Security in the Gig Economy

Freelancers and independent contractors have several common questions regarding Social Security benefits. The following are answers to some of the most frequently asked questions:

As an independent worker, am I required to pay Social Security and Medicare taxes?

Yes, self-employed individuals must pay a self-employment tax which funds Social Security and Medicare. The self-employment tax rate is 15.3%, with 12.4% funding Social Security and 2.9% funding Medicare. You calculate the tax on your net earnings from self-employment.

How do I report my self-employment income and pay self-employment taxes?

You report your self-employment income and calculate your self-employment tax liability on Schedule C, Profit or Loss from Business, and Schedule SE, Self-Employment Tax. You report and pay the self-employment tax on your annual Form 1040 tax return. Quarterly estimated tax payments are required for self-employment taxes over $1,000.

Will I receive Social Security benefits for my self-employment income?

Yes, the self-employment taxes you pay are credited to your Social Security earnings record and count toward determining your Social Security benefits, including retirement, disability and survivor benefits. Your benefit amount will depend on your average lifetime earnings.

Can I contribute to an individual retirement account (IRA) based on my self-employment income?

Yes, as a self-employed individual you are eligible to contribute to an IRA, such as a traditional IRA or Roth IRA. The contribution limits are the same as for individuals not self-employed. In 2020 and 2021, the annual IRA contribution limit stands at $6,000, rising to $7,000 for individuals aged 50 or above. The tax deductibility of your IRA contributions hinges on your income and the specific type of IRA.

Consulting a tax professional regarding your self-employment taxes and retirement planning is advisable. They can help ensure you pay only what you owe and take full advantage of available tax benefits. With proper planning, self-employment can provide both income opportunities as well as long term financial security.

Conclusion

As you navigate the gig economy, understanding how to optimize your social security benefits is crucial. Keep detailed records, consider your tax strategy, and evaluate how income fluctuations impact your benefits. Seek expert guidance to ensure you maximize this safety net. With proper planning, you can take control of your financial future. Though the path has challenges, knowledge and preparation empower you to navigate the gig economy successfully. Your diligence now pays dividends when you need it most. You’ve got this!

Leave a Reply