Smart savings tips for freelancers or contract workers: Are you seeking to take control of your finances and build a secure future? Managing your finances presents unique challenges, from fluctuating income to uncertain tax obligations

Freelancers and contract workers often face irregular income and uncertain work contracts, making it essential to have an emergency fund in place. Creating a monthly budget that encompasses personal and business expenses is crucial for financial stability, and prioritizing expenses is key to effective budgeting. Additionally, maximizing retirement savings and understanding tax obligations are vital components of building a secure financial future as a freelancer or contract worker.

Emergency Fund: Why Freelancers and Contract Workers Need One

The nature of freelance work, characterized by fluctuating monthly income, necessitates having an emergency fund in place. As a freelancer or contract worker, you may face periods without income or unexpected delays in payments. It’s crucial to establish this financial buffer to cover basic living costs, such as housing, food, and utilities, during such times.

Building an ideal emergency fund, guided by smart savings tips, ensures it holds a minimum of three times your monthly expenses. This safeguards against unforeseen costs, like urgent car maintenance or sudden health issues, without resorting to high-interest credit cards. This financial reserve not only alleviates stress during low-income phases but also preserves your credit score by keeping you debt-free.

Placing your emergency savings in a high-yield savings account enhances the fund’s growth, acting as a lifeline for your freelance business. It’s a key aspect of personal finance that ensures continuity and stability, especially in the unpredictable gig economy. By doing so, you safeguard your personal budget and secure your freelance lifestyle against economic ebbs and flows.

| Savings Tips | Details |

|---|---|

| High-Interest Savings | Earn more from your fund. |

| Monthly Savings Goal | Automate transfers to meet your emergency fund target. |

| Expense Tracking | Use accounting software to monitor spending and adjust your budget. |

| Reserve for Tax Obligations | Set aside a portion to avoid surprises during tax payments. |

Remember, an emergency fund isn’t a luxury—it’s one of the smart savings tips and necessity that affords peace of mind and financial stability for freelancers and contract workers.

Creating a Monthly Budget for Personal and Business Expenses

When creating a monthly budget, it’s essential to differentiate between personal and business expenses. This distinction clarifies your overall costs, making it easier to manage your finances. Personal expenses might include your rent or mortgage, utility bills, grocery costs, and allocations for retirement and emergency savings. Each of these should be listed as your non-negotiable costs.

Conversely, business expenses are those that directly impact your freelance business or contract work, such as your internet and phone bills, health insurance premiums specifically for business owners, projected tax payments, and any subscriptions to tools or services essential for your work.

To streamline your budget:

- Categorize expenses as either personal or business-related to gain a transparent view of your expenditures.

- Prioritize your spending, focusing on essential expenses like housing, utilities, and food before anything else.

- Adopt budgeting tools or software to assist in categorizing and monitoring expenditures with greater ease. It’s especially useful for freelancers who might have variable income sources requiring a flexible budgeting approach.

- Regularly review and modify your budget to adapt to any financial changes you experience, ensuring your budget remains aligned with your current financial status.

A practical budget for freelancers and contract workers must account for the irregularity of their monthly income. Incorporating a section in your budget for taxes is particularly important since taxes aren’t automatically withheld from your income. Saving for taxes each month helps avoid the strain of a large, unexpected tax bill. Additionally, developing a habit of tracking expenses — either manually or through accounting software — reduces the likelihood of financial surprises.

Here’s a simple table that can help illustrate the monthly budget division:

| Category | Expense Type | Examples |

|---|---|---|

| Personal Expenses | Essential | Rent, groceries, utilities, savings |

| Business Expenses | Operating | Internet, phone bills, health insurance, tools, taxes |

| Discretionary Expenses | Optional | Dining out, entertainment, vacations |

Remember that staying attuned to your business finances is as paramount to your success as the quality of your work. Regularly reconciling your budget with your business bank statements ensures that you remain aware of your financial health and allows you to make informed decisions about your freelance business.

Smart Savings Tips for Maximizing Retirement as a Freelancer or Contract Worker

The absence of employer-sponsored retirement plans means freelancers and contract workers need to take a proactive approach to their retirement savings. With the uncertain future of social security, individuals in the gig economy must start saving early. By doing so, they allow their money more time to compound and grow, a crucial step toward long-term financial stability.

There are several retirement savings options available to freelancers that come without the attachment to traditional employer plans:

- Traditional IRA: Ideal for freelancers seeking tax advantages now, as contributions to a Traditional IRA can be tax-deductible. The maximum contribution is $6,000 per year or $7,000 for those aged 50 or older.

- Roth IRA: Roth IRAs offer the prospect of tax-free growth and penalty-free withdrawals after retirement age, with the same contribution limits as Traditional IRAs. They’re great for those who expect to be in a higher tax bracket in the future.

- Self-directed Solo 401(k): This type of plan is suitable for freelancers keen on saving more, as it has much higher contribution limits. It also offers flexibility in how the savings are invested.

- Taxable Brokerage Accounts: While these don’t have the upfront tax benefits of retirement accounts, they offer no limit on contributions and flexibility in withdrawals. Taxes are due on capital gains.

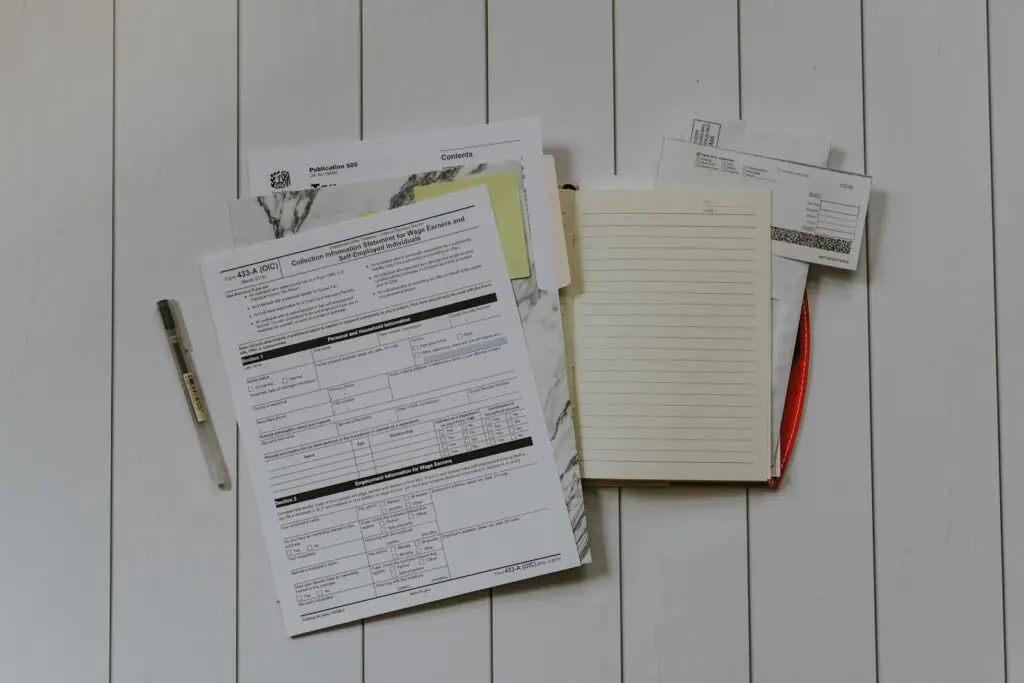

Managing Taxes and Understanding Tax Obligations

Managing the tax obligations that accompany the freedom of freelance or contract work can be a daunting task. As there are no tax withholdings from payments received, freelancers must set aside a significant portion of each payment—around 25%—specifically for tax purposes. One smart savings tip is to proactively engage with a knowledgeable tax professional.

Hiring an accountant or tax advisor can provide invaluable assistance. These experts are equipped to help you properly estimate your tax payments, understand potential tax breaks, and ensure compliance with tax laws. For freelancers, making estimated quarterly tax payments is a legal requirement, and failing to do so can result in penalties.

A tax professional does more than help with tax estimates and deadlines; they can also advise on long-term financial strategies, including personalized investment and retirement planning. This is especially pertinent for self-employed individuals, as they are responsible for their retirement funds and lack access to employer-sponsored plans.

Moreover, understanding the array of tax deductions available to freelancers is essential for maintaining a healthy freelance business. Deductions can range from a home office setup to travel expenses and equipment purchases—all nuanced areas where a tax pro can offer insight, ensuring you maximize deductions while remaining within legal boundaries.

Freelancers and gig workers must understand their IRS classification and maintain diligent records for tax purposes. The IRS offers guidance to determine contractor status, which affects how taxes are managed. It’s not just about staying compliant; it’s about seizing opportunities within the tax system to enhance financial stability for your freelance business.

Through collaboration with accounting professionals, freelancers can leverage smart savings tips to gain clarity on tax obligations, maintain financial order, and secure peace of mind. This allows freelancers to focus on their expertise—delivering exceptional service or products—while leaving the complexities of the tax world to those who navigate it daily.

When moving further through the outline, ensure the subsequent passages talk about practical tips for freelancers in setting up their savings and budgeting for their unique income patterns, recognizing the importance of building an emergency fund and exploring the benefits of using tools like accounting software for streamlining financial tracking. Always keep the writing clear, concise, and focused on tangible steps that can empower freelancers and contract workers to manage their finances effectively.

Building and Maintaining a Healthy Credit Score

A healthy credit score is a pivotal asset for freelancers and contract workers, who often depend on their financial credibility to unlock important opportunities. Without a traditional paycheck, a solid credit score can serve as a testament to financial reliability when interacting with landlords or financial institutions. This credibility becomes indispensable when applying for housing or securing loans to expand one’s freelance business.

For freelancers, periods of fluctuating income are common, making a high credit rating a form of security. Maintaining an excellent credit score ensures that, even in slower months, freelancers have the option to apply for loans that can bridge the gap and keep their operations afloat. More so, in times of growth, a freelancer’s credit score can influence the willingness of investors or banks to provide funding, often dictating the success of such endeavors.

By strategically using credit cards, particularly those that offer rewards, freelancers can not only streamline business expenses but also bolster their credit scores. Such financial tools not only improve creditworthiness but also offer tangible perks like cashback or travel rewards, which can translate into significant annual savings.

In conclusion, a high credit score elevates a freelancer’s profile, enabling them to access emergency funds beyond their savings and solidifying their financial stability. Conscientious bill payment and strategic credit use are foundational practices to maintain and improve one’s credit rating, securing a safety net for unforeseen expenses and positioning freelancers for future financial success.

Setting Savings Goals for Short-Term and Long-Term Financial Stability

For freelancers looking to achieve both short-term and long-term financial stability, setting savings goals is crucial. Begin by identifying what financial independence means to you, whether it’s the freedom to retire early, the ability to work from anywhere, or making a dream of moving abroad a reality. These long-term visions can be highly motivating and provide you with a clear direction.

Create a mix of both short-term and long-term goals. Short-term goals might include building an emergency fund or saving for upcoming tax payments, while long-term goals might involve accumulating a retirement fund or setting aside money for real estate investments.

To make these goals more tangible and achievable, consider incorporating the following these smart savings tips:

- Set Clear Numerical Targets: Decide on the exact amount you want to save for each goal. Whether it’s $5,000 for your emergency fund or $50,000 for a home down payment, having a numerical figure in mind makes it easier to track progress.

- Work Backwards: Once you have the numbers, determine how much you need to put aside monthly or yearly to hit these targets. This step will help you understand the timeline and the regular commitment required.

- Prioritize: With all the potential financial obligations, it’s important to prioritize your savings goals. Determine which goals are most urgent or important, and allocate your resources accordingly.

- Automate Your Savings: Set up automatic transfers from your checking account to separate savings accounts dedicated to each of your goals. Automation makes saving consistent and hassle-free, ensuring you’re regularly contributing to your milestones without having to actively remember each time.

- Adjust As You Go: Revisit and adjust your savings goals as your freelance income fluctuates. Keeping an eye on your progress will allow you to make necessary changes and stay on track.

By following these smart savings tips, you’ll not only create a clear path toward financial stability but also enjoy the peace of mind that comes with having a solid financial plan.

Note: This passage aligns with the provided facts and follows the formatting guidelines, omitting a table or list as neither seemed to fit naturally within this passage’s context. If a table or list is desired in subsequent sections, please advise.

Utilizing Business Finances and Accounting Software for Financial Management

To streamline financial management, freelancers should consider utilizing sophisticated accounting software. With features such as receipt scanning and payroll processing, this software can simplify the tracking of expenses and income, which is critical for maintaining a positive net income. Accurately monitoring these numbers is key to ensuring that you’re not operating at a loss, and it’s essential for paying yourself a salary – a vital consideration for any freelancer or contract worker looking to sustain their business.

Choosing the right accounting software entails evaluating the tools you need, bank compatibility for seamless transaction imports, a reputation for reliability and security, and, importantly, whether it aligns with your budget. Employ smart savings tips to make a wise selection. Here’s a simple table outlining considerations when choosing accounting software:

| Consideration | Details |

|---|---|

| Tools Needed | Receipt scanning, payroll, invoicing |

| Bank Compatibility | Seamless integration with your business bank account |

| Reputation | User reviews, security features |

| Budget | Cost relative to benefits and features |

Combining a business bank account with accounting software further refines financial management. A dedicated business account separates personal and business finances, making it easier to manage income and expenses and prepare for tax obligations. This separation not only helps maintain clean records but also strengthens your financial stability through better visibility into your business finances.

Furthermore, integrating money management apps with features like automated financial reporting and invoicing, guided by smart savings tips, can save time and reduce the likelihood of errors. This provides more flexibility for freelancers to focus on their core work. Remember, time is money, and the use of these tools translates to significant time savings and heightened efficiency for freelancers and contract workers.

Finally, recognizing the impact of long-term projects on financial health is essential. Such projects, coupled with smart savings tips, offer a more stable income source, enabling freelancers to reinvest in their businesses and achieve their savings goals. By managing finances effectively through the right technology and practices, freelancers can pave the way for success and long-term financial health.

I truly appreciate this post. I?¦ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again